|

|

|||

| |

|||

|

|

|||

Weather and Insurance

The

information contained here provides an overview of my research in this

area. A more detailed account of this research can found in my PhD thesis (18MB), and

references therein.

- Recent UK windstorm Events

- The Great Storm (16th October 1987)

- The Burns' Day Storm (25th January 1990)

- Windstorm Erwin (8th January 2005)

- Windstorm Kyrill (19th January 2007)

- Catastrophe

Modelling

- How are the costs of weather events estimated?

- Climate Change and the Insurance Industry

- What's the current position of the industry?

- To what can we attribute increasing losses?

- Can we predict future losses?

One

of the cornerstones of the (re)insurance industry is the managing of

the risk associated with natural hazards, such as earthquakes and

flooding. Insuring against adverse effects of weather is a core

business. Increasingly, weather related events are dominating not only

the news, but also losses to global non-life insurers.

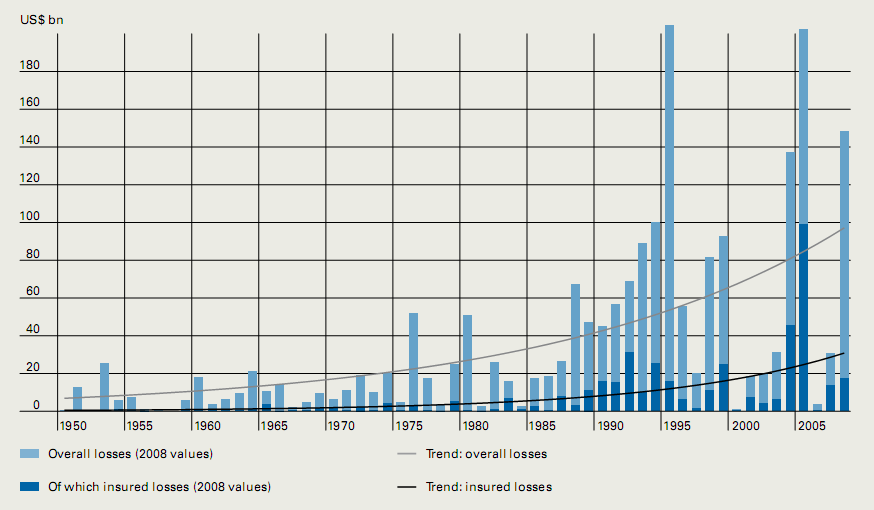

Worldwide, the costs of catastrophic weather events have increased dramatically in recent years, as shown in Figure 1. Insured losses have risen from a negligible level in 1950 to an annual figure exceeding $10bn in the 21st century. When losses from non-catastrophic weather related events are included this figure is doubled. The trend exhibited is influenced by economic, demographic and geographic shifts and well as natural factors. Three quarters of the most expensive 40 insured losses of all time were windstorm related.

Figure 1 - Worldwide

annual economic and insured losses from large events. Click

on image to open in a new window.

The

magnitude of losses associated with weather related catastrophes can

carry

serious economic consequences for the region and people affected, the

political

body responsible for that region as well as the insurance industry. All

three

parties have a vested interest in managing the risk posed by severe

weather

events, and mitigating against them. One of the keys of risk management

is the

identification and analysis of the risk. Catastrophe modelling is a

tool that

provides a thorough analysis of the risk, in this case a thorough

understanding

of the potential impact of weather events at a certain location.

Generally,

a catastrophe model is comprised of four modules; hazard, exposure,

vulnerability and loss. The hazard

module contains information on the nature of the weather event,

incorporating

such things as storm track, intensity and duration. Within the exposure

module

details of the type of properties at risk are stored, including

building

specifications and age. The third module, vulnerability, is key to

producing a

realistic catastrophe model. Hazard and exposure are combined to

produce a

vulnerability curve, which describes the expected damage for a given

magnitude

or intensity of hazard. A fourth component, loss, is usually employed

by the

insurers, and incorporates the vulnerability curve and policy

conditions, to

produce estimates of insured loss.

Generally,

insurers make underwriting decisions for risks of economic losses based

on information from historical events. Should the pattern of these

events be altered, such as a shift in climate, then the basis of these

decisions is changed. Owing to this fact, within the finance sector,

insurers have been prominent in addressing the climate change issue.

However, the short-term nature of insurance means that the topic of

potential climate change is met with some scepticism within certain

sectors of the industry.

Franklin Nutter, president, Reinsurance Association of America in a statement to Congress April 1998

The insurance industry could be put under considerable strain due to shifting patterns of extreme weather events driven by climate change. The following table lists potential changes in extremes and their effect on the Insurance industry.

| Climatic Change | Effect on Insurance Industry |

| Higher maximum temperatures, more hot days and heat

waves over nearly all land areas |

Increasing numbers of heat waves and droughts will affect health, life, crop, property, business interruption lines. |

| More intense precipitation events | Increased flooding, in particular flash flooding, will effect property, flood, vehicle, business interruption, life, health lines. |

| Increased summer drying | Risk of drought grows and subsidence and wildfire events increases, impacting property, life, health lines. |

| Increased intensity of mid-latitude storms | Windstorm damage increases effecting property, flood, vehicle, business interruption, life, health insurance. |

A

report by the Association of British Insurers (ABI), "A

Changing Climate for Insurers" concluded:

Increasing Losses

Insurance costs have been rising globally since 1970s (as shown in Figure 1), essentially due to increases in population in regions that are at risk, but also in part to the increase in frequency and severity of certain forms of extreme weather events. It is very difficult to disentangle the socio-economic impacts (such as increasing population, increasing population density in high risk areas, increasing wealth, land use change etc) and natural factors (such as changing patterns of extreme weather).

Global weather-related losses in recent years have been trending upwards much faster than population, GDP, premiums, non-weather related events. Some studies attribute this solely to increased vulnerability, but these studies often overlook the fact that human actions mask losses that would otherwise manifest (such as improved building codes, early warning systems, flood control, crop irrigation, etc).

Overall, the attribution of the increasing trend of insured loss from weather events has not been dealt with in the literature satisfactorily. However, future changes in the severity and frequency of extreme weather events are likely to accelerate the current trend, impacting further on the insurance industry.

The Stern Review on the economics of climate change concluded that....- "The costs of extreme weather events are already high and rising, with annual losses of around $60 billion since the 1990s (0.2% of World GDP), and record costs of $200 billion in 2005 (more than 0.5% of World GDP). New analysis based on insurance industry data has shown that weather-related catastrophe losses have increased by 2% each year since the 1970s over and above changes in wealth, inflation and population growth/movement. If this trend continued or intensified with rising global temperatures, losses from extreme weather could reach 0.5 - 1% of world GDP by the middle of the century. If temperatures continued to rise over the second half of the century, costs could reach several percent of GDP each year, particularly because the damages increase disproportionately at higher temperatures."

Quantifying future losses

Consensus

in the scientific

world is that climate change is a reality for this and future

generations

(IPCC, 2007). Any shifts in

the frequency

and intensity of extreme events, associated with climate change, will

have a

direct effect on general insurance, with the greatest impact being on

property

insurance.

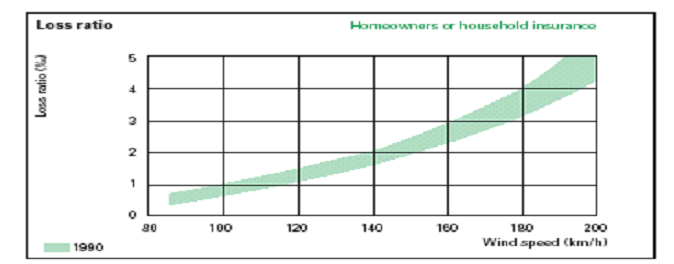

Figure 2 - Household insurance loss

ratios in Great Britain, at various windspeeds recorded in the January

and February 1990 storms.

Source: Munich Re (2002)

This illustrates the danger to the insurance industry; a small shift in

climate (such as a slight increase in peak gust speed in storms) could

have a

dramatic impact on insured losses.

The

insurance industry finds itself in a unique position with regard to

climate change. On the one hand the potential affect of a shifting

climate

could result in significant financial losses. On the other hand the

nature of

insurers as risk assessors means they are ideally place to evaluate

these

impacts. Pre-existing tools, such as catastrophe models, can be adapted

to

estimate losses in future climates.

Recent

hurricane losses in

IPCC (2007). Climate Change 2007: Impacts, Adaptation and

Vulnerability. Contribution of Working Group II to the Fourth

Assessment Report of the Intergovernmental Panel on Climate Change.

M.L. Parry, O.F. Canziani, J.P. Palutikof, P.J. van der Linden and C.E.

Hanson (Eds). Cambridge, UK: 976.

McGhee, C., R. Clarke

and

J. Collura (2007). The Catastrophe Bond Market at

Year-End 2006, MMC Securities: 42.

This

page was last updated on

20th October 2009. Every effort is made to ensure links from this page

are still active; however, if you find they are not please let me know.

This

page was last updated on

20th October 2009. Every effort is made to ensure links from this page

are still active; however, if you find they are not please let me know.